16 de December, 2019

This is the most complete report I have ever done, showing an analysis of the Port market, the enterprise, the economic cycle, the recommended strategy and possible returns. If “you’re out of time, brother”, read this first page and then jump straight to the end (take the opportunity to see the photos), where you’ll find the phone number and e-mail address of those who can explain everything quickly, without reading.

Porto View is the real estate launch of the year. A development that brings together characteristics that provide versatility of use, differentials that make it unique and with exceptional profitability.

It’s unique in that it’s the perfect location to get to know the whole city on foot, to enjoy the most epic sunset with views of the city in the privacy of the balcony of the apartment at the end of the day and then go out again on foot to nightclub.

It is also distinguished by one of the most awarded architects in the country – José Gigante – and by the security of one of the largest European real estate investment funds – Firce Capital.

It is versatile because it can serve as a base for the Brazilian who knows Europe in depth, staying exactly 18 minutes from the airport with flights of €30 to €150 to major cities on the old continent, earning money when the owner is away – instead of being a dredger of resources.

It is also perfect for the investor, being a true cash flow machine, by the differentials of location, architecture and views, to generate returns above 1% per month in rent – in the famous cases in which the property itself can pay the financing – or 42,000 Euros in resale.

The images that marked my life as a tourist are all related to views. It’s the image of the sunset at Jardim do Morro – Ponte Luís I in Porto, which looks like such a perfect photoshop. From the top of São Jorge Castle in Lisbon. From the moon reflected in the sea in the hotel’s high-floor room in Miami. From the top of Yosemite’s famous Tunnel View that amazes the most peaceful spectator.

It’s pure magic. It’s in the mind. It is no coincidence that the Eiffel Tower, London Eye, Luís I Bridge and São Jorge Castle are tourist attractions that receive millions of visits annually. They are views that make the tourist have the pleasant sensation of understanding and dominating all the beauty and complexity around them.

That’s why properties with views have the highest turnover. The statistics prove that the apartments with the highest profitability in the city always have views, just like the Porto View.

View Porto Vivo

An apartment in this development will allow the lucky tourist or owner to have the pleasant sensation of understanding and dominating the city with comfort and privacy, sitting on your balcony, having a good wine. There’s no better feeling.

For the investor is more return and security of having a property always occupied.

Those mountain goats would feel good in the harbor. In essence it’s a series of cliffs and hills. There’s no other way to describe it. It’s a continuous up and down that tires if it’s not well administered.

The secret is to start from above and go down in a zigzag on both sides of Av. dos Aliados, between Santa Catarina and Bolhão on one side, and Almada, Cedofeita and Clérigos, on the other side. In the end, it joins everything in the Sé, Rua das Flores, Rua Mouzinho da Silveira, Palácio da Bolsa until arriving in Ribeira.

Porto View is special because it’s upstairs in Trindade. For the tourist just put your foot out and you’ll be in the right place to start. In the descent every saint helps.

Getting down there, you must not dare to challenge the hills on the way back. The 5 Euros of Uber will be very well spent to return at the door of the apartment, or just take the subway from São Bento or Jardim do Morro in Gaia and get off at Faria Guimarães station that is glued to the building.

A lot of first-time sailors think that the best place to stay in the city is in Ribeira, which is “down there”. It doesn’t take long to learn that it will be a daily battle up the hill and with the experience, the next time, you will be staying “up there”, where it is more comfortable and cheaper.

The Port is good, beautiful and cheap. Win international prizes every hour (it’s good). It has a unique architecture, river and sea in the same place, kept totally clean (it is beautiful) and safe. And it’s one of the lowest costs in all of Europe (it’s cheap), including hundreds of low-cost daily flights from all over Europe and the world.

Prizes pile up in the mayor’s office. Best European tourist destination elected by the European Consumers Council in 2015, 2016, 2017 and 2018. One of the 20 destinations to visit in 2020 elected by Travel & Leisure Magazine. Best city to live in elected by Time Out Magazine in 2018 and one of the lowest costs of living in Europe according to Expatistan 2019.

José Avillez, our Gordon Ramsay, besides getting tired of changing his words to be understood in the Meste do Sabor da Globo in Brazil, is also tired of participating in the inauguration of new restaurants in the city. They are new restaurants and shops, but all very handmade and very personal, in the Tuga Way of Life. A real charm.

The claim of the Paris demonstrations belongs to an economic group, of the European family, which earns an average of almost 40,000 Euros per year. Open your eyes because there are 500 million people in this group.

Don’t you think that at least 50% of the 500 million don’t have €250 per capita to take a weekend getaway to a good, beautiful and cheap place like Porto? And that those same 50% do not have €1,000 per capita to spend 10 days visiting Portugal?

And that besides all the European public, there is still a market in the Americas and Asia to complement?

The tourism consumer market is simply giant and does not stop growing in Porto, where there are 12 million more per year in the airport alone (ongoing duplication!), with growth of 130% in the last 7 years, having alone the double of foreign tourists compared to Brazil.

With this proposal of the good, beautiful and cheap, Porto tourism still goes far.

The phenomenon of tourism is one of those generational trends, long term, due to the democratization of travel and the change in consumption behavior.

Prepare the smallest suitcase of your life and enjoy. Airlines invent the very low-cost flights, where every penny of spending is scrutinised, that even the printing of the ticket is charged and boarding agents are real snipers of suitcases to ship, and thus offer tickets accessible to most mortals, such as a flight from Porto to Barcelona for €30, round-trip.

Kitchen Porto View

In Brazil, the phenomenon of low-cost flights is still only a threat and I understand that sometimes it is difficult to understand, but it is a consolidated reality in the old continent.

Those 3 hours that the influence spends on the beach in Ibiza to take the perfect picture changed the aspirations of people in general. That business of showing the album to the poor guy is a thing of the past.

The purchase of house and car has already become an unattainable dream and the money is for the experiences, with priority for travel, tours, restaurants and lots of photos on Instagram.

Behavior change and affordability are like gasoline and fire brought together to create the explosion of global tourism.

Of all the risk factors, that’s the most serious. There may be an excess supply of hotel rooms to pressure the market. In Porto it is less likely, because the historic centre has practically no more land available, but make no mistake, because it happens in all regions and segments.

Who doesn’t remember the flooding of flats in the 90s or the commercial halls of the 10s in Brazil? Who wants to be in high performance real estate, has no way to escape this risk, but has how to manage it.

I have experience in this and it is with great conviction that I say that the only characteristic that saves is the quality of the property. It needs to be well located, it needs to have relevant differentials and good finishes.

No quality commercial building in Faria Lima was left empty, for example. And the flats in the Jardins make it a beauty to this day.

If you don’t have quality and differential, you’ll have to run away from the streak. The first properties to enter the Portuguese market will be the first to ask for water. They are uncomfortable because they have been reformed on the thighs, have generic decoration and do not present any appeal other than the price.

Don’t worry about them, they cost the original owners very little. But be very careful not to buy that lemon now. Their destination is long-term rental, own use or sale – usually at the worst time.

I don’t want this for my readers, so it doesn’t matter if I don’t buy Porto View, give preference to quality that is so obvious that anyone can see it in the AirBnB ad photos. Just so I don’t have to sell when I get a hiccup.

But that’s why I’m so excited about Porto View. It has the differential of the views, the location with everything on foot and the renowned architect. Three in a single development is to order music at the Fantastic. It is an extremely resilient product that will not suffer at any time in the market.

Terrace Porto View

The promoters challenged me: – “You will not find property cheaper than Porto View in the historic center. You can look all you want.”

I went after it just to counter it. I entered my favorite site – idealista.pt – forget the others, this is better, where are all the ads and with the best search system on the map.

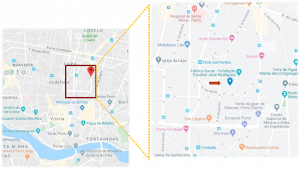

I chose houses in the district of Porto, municipality of Porto, region of the historical center (Cedofeita, Santo Idelfonso, Sé, Miragaia, São Nicolau, Vitória), “new construction”.

The list gave 143 properties with an average price of €3,808 per m2. I got off to a bad start because Porto View has a product of €2,650 per m2. I looked at every pitch and every ad.

I finally found the first competitor for €2,400 per m2, but I soon found out that the area includes the garden. Cheap trick. Including the gardens, Porto View falls to less than €2,000 per m2. I had to rule it out.

Another development for less than €2,650 per m2. It was too good to be true. This time it included a terrace. It was really fucking expensive. Another old move to reduce the price per square foot.

I wanted any development for less than €2,650 per square metre of PRIVATE COVERED GROSS AREA. And so I spent the next few hours in vain to find out that there was nothing like it cheaper in the city.

But what already looks cheap is actually even cheaper. Similar apartments in the city, i.e., those with views have an even higher price.

In this comparison I learned that Porto View is much cheaper than the second place, which has a price of €3,511 per m2. Not to mention that the entire city had only seven real estate options with some view.

Porto View Room

Porto View is really a rare asset that is 25% cheaper than the second most affordable development in the city.

The best business in a heated market like Portugal’s is to incorporate, the second best is to become a partner of the developer through the purchase in the plant at a discount on the market value.

As was clear from the survey above, Porto View has great potential for appreciation just because it is being sold cheap. The potential profit before income tax and commissions is €42,000, considering that properties with a view are sold for at least €3,300 per square meter.

This figure does not take into account any appreciation of the market itself. It’s really just for buying cheap at the right time. And don’t think the builder’s trying to do charity. He needs to sell fast to have enough money to build without additional investments.

It is with the money advanced by the clients that the work will go ahead and the return on the builder’s capital will be interesting.

Don’t worry if he doesn’t sell. It will not be a problem because in addition to having 30% of the flats sold in 1 week, the owner is a European fund with more than €2 billion in the pocket (FIRCE Capital).

Porto View Room

Keep in mind, however, that the quest for greater returns from the builder is your best friend. He wants to sell fast so he doesn’t have to pay for his pocket work, so he needs to give big discounts.

PriceWaterouseCoopers (PwC) expects the average daily revenue of a hotel room in Porto to be €82 by 2019. . In other words, each room in Porto will yield an average of €82 per day x 365 days, resulting in a turnover of €29,930.

Let’s face it, an apartment that is more than triple the size and has all the comforts of a large living room, full kitchen, bathrooms and spacious balconies, such as Porto View, has a performance similar to that of a hotel room that is less than 20 square meters.

Assuming that a huge Porto View apartment performs as well as a 20m2 hotel room, the net profit would be €15,000 per year, but after PwC’s last ball footstep in delivering the Oscar’s best film envelope in 2017, I could never trust them again.

Jokes aside, I always prefer to make a check with the cold reality of the streets. For me, the average daily rate per person – adjusted for seasonality – offered on AirBnB and Booking within 500 meters of the property is the best way to get a good estimate of turnover.

Within this criterion, and without taking into account the differentials of Porto View, the average daily rate would be €91 with 80% occupancy, resulting in a revenue per apartment of €72 per night (less than the €82 from PwC).

| Annual Revenue | 26.572 € |

| (-) Fixed (Utilities, maintenance, etc) | -4.750 € |

| (-) Variables (commission, cleaning, laundry, etc.) | -4.596 € |

| (-) Management | -4.306 € |

| (=) Operating result | 12.919 € |

| (-) Taxes | -194 € |

| (-) Interest | 0 € |

| (=) Net result | 12.725 € |

| Investment | 184.225 € |

Even so, the net result would be €12,725, doing absolutely nothing but checking the extract, because the management will be totally outsourced. The net return of 6.9% per year is almost 40% higher than the average real estate in the plant for tourists in the city.

With financing it is possible to raise this return to more than 1% per month. You only need to finance at least 55% of the acquisition. It is certain that the net profit will reduce to €11,079, however investment will fall further, and the return will rise to 12.8% per year or more than 1% per month.

| Annual Revenue | 26.572 € |

| (-) Fixed (Utilities, maintenance, etc) | -4.750 € |

| (-) Variables (commission, cleaning, laundry, etc.) | -4.596 € |

| (-) Management | -4.306 € |

| (=) Operating result | 12.919 € |

| (-) Taxes | 0 € |

| (-) Interest | -1.684 € |

| (=) Net result | 11.235 € |

| Total Investment | 87.975 € |

It is important to point out that the amount financed in the deed does not depend on how much has already been paid directly to the builders. The payment schedule of Porto View is 7 installments of 10% each during the work, but even so the bank can finance up to 70% of the acquisition in the deed (up to 90% for Portuguese or residents), which in practice means receiving money back at the time of the deed.

This is a classic case in which the rent of the property can pay the instalment of the financing of the property without any problem, even in cases where the financing is 70% and the duration of the loan is only 13 years.

Having a 1% return per month is good anywhere in the world, but it’s important to understand that you can’t compare the returns in Euros with Reais.

The Euro is a strong currency that retains value over time because it is backed by the economies of 27 countries with more than 500 million inhabitants. Over the last three years, the Euro has appreciated 34% against the Real.

Those who invested in real estate in Portugal not only had the effect of increasing the value of the real estate, but also gained 34% in the purchasing power of the currency. It is common in cases in which the total return exceeded 70% in the period.

Every portfolio deserves a percentage in hard currency, either to maintain purchasing power or to be an emergency value reserve if things don’t go well in Brazil.

For those who understand economic cycles and are concerned about what might happen in the future, I have two comments.

Don’t try to predict the cycles. It is perfectly possible to know the direction, but impossible to know the moment of the turn. The most important thing is always to position yourself in good products and never to break in order to continue investing in the market.

Use only the money that is left over to invest. If the bank fails to finance, no problem, pay from your own resources. If the market fails in resale, no problem, wait until the prices come back and even take advantage to buy more properties cheaper.

In the worst crisis in recent history, prices began to react in 3 years. And remember that tourism can fail for 1 or 2 years, but it also always comes back with force, because it is a lifestyle decision.

For those who want to know where we are in the cycle, the European market is three years behind the US. The crisis went down there in 2008 and here in 2011. The U.S. market is only just beginning to show signs of a lack of breath in prices, but still no relevant price drop.

We have a few years of strong market ahead of us. To put it in context, some years may represent a significant appreciation (which is not in my accounts). In the last two years, the price of the average square meter sold in Porto has risen by 47%.

There is still a large avenue of appreciation ahead that will continue to be trailed as long as employment is up, interest rates are down and tourism is growing.

I didn’t put the information about prices, sizes and payment terms on purpose. In this way you will be able to meet the incomparable and friendly Rafael Nunes of 100 Domus – the largest real estate agency in Porto – who will have the pleasure of passing all the details.

And you can let us at Atlantic Bridge give you all the legal, tax and financial support you need.

Contacts

Rafael Nunes

Telephone: +351 912 896 446 (has whatsapp!)

E-mail: rafael.nunes@100domus.pt

Author: Marcio Fenelon

Real Estate Investment

Author:

Atlantic Bridge